Content Type:

Trends

Project Type:

-

System Name:

-

Installation:

Exterior

Construction Trends

1. Rising Interest Rates

As interest rates have steadily risen for more than a year, coupled with high mortgage rates, the residential sector has experienced a significant deceleration. Data from the USA Census indicates a year-over-year decline of 20% in building permits from January to April. This downward trend is expected to persist throughout the summer and extend into the entirety of 2023.

Forecasts predict a decrease in real consumer spending for 2023 amidst an uncertain economic landscape, resulting in sluggish demand for home builders. Deloitte’s analysis aligns with this projection, underscoring the potential challenges that lie ahead.

Home builders will likely experience sluggish demand as real consumer spending is forecast to fall in 2023 amid an uncertain economic environment. – Deloitte, 2023

On the other hand, infrastructure projects are anticipated to face lower repercussions from the economic slowdown in 2023. The backlog of projects remains robust, offering a lifeline to many construction companies throughout the year.

However, as construction companies approach July, they will continue to grapple with various challenges. These include labor shortages, increased lead times, and mounting pressure to prioritize the use of sustainable materials and methods. Construction firms will have to adapt and innovate to ensure productivity and cost-effective project delivery.

In light of the unpredictable conditions expected in 2024, construction companies must proactively invest in and develop processes to improve efficiencies throughout 2023. This strategic preparedness will play a crucial role in effectively maneuvering through future uncertainties and achieving success in the industry.

2. Virtual Design and Construction

In response to the economic slowdown, companies are proactively leveraging data and software to enhance productivity. This growing trend is driving the adoption of various virtual design and construction software solutions.

Furthermore, effective project management facilitated by virtual design and construction methods enables companies to demonstrate their organizational and collaborative skills, positioning them to secure a larger market share of projects. The time-saving benefits of these technologies significantly contributes to reducing overall organizational costs.

To optimize the usage of virtual design and construction tools, designers have an important role to play. They should advocate for building material manufacturers to develop easily accessible, detailed, and up-to-date BIM libraries and comprehensive supporting documentation.

By doing so, designers can ensure a seamless integration of these materials into the design and construction process, fostering efficiency and accuracy.

3. Sustainable Materials

Sustainable materials are increasingly important in the North American market as governments implement environmental regulations to address the significant volume of waste generated during material production and use. Industries across the board are faced with challenges as they reevaluate their internal processes to align with the principles of materials sourcing and lifecycle management.

Within the construction industry, several sustainable materials are being continuously improved upon, with low-carbon concrete being of particular interest. Concrete has historically been the most widely used construction material. However, its susceptibility to deterioration from external factors such as water, wind, stress, and pressure has posed significant challenges.

Low-carbon concrete aims to address this issue by using less cement and incorporating additives that lower greenhouse gas (GHG) emissions. Companies like Lafarge offer different stages of CO2 reduction while maintaining 100% of the performance of traditional concrete.

It’s worth noting that although low-carbon concrete shows promise in reducing CO2 emissions, its widespread adoption and implementation still face challenges, including cost implications, the availability of alternative binders, standardization, and scaling up production.

Architecture & Design Trends

1. Curves

One of the prevailing trends as we enter the summer season is the growing popularity of curved designs. This significant shift in architectural aesthetics has captured attention across various industries, particularly in commercial ceilings.

Our dedicated design team has been diligently working to integrate our products into extraordinary designs that embrace the allure of curves. This is part of a larger movement towards bold architecture, where conventional and uninspiring designs are being replaced by structures that leave a lasting impact.

The era of monotonous and box-like “modern” buildings is waning. As we emerge from the challenges posed by the pandemic, there is an increasing demand for buildings that stand out and create a lasting impression. The appetite for visually striking architectural marvels is on the rise.

Anticipate encountering an abundance of curved architecture in the near future, particularly in interior designs. The incorporation of curves adds a touch of elegance and fluidity, creating spaces that are visually captivating and inviting.

2. Solid Colors

In the early months of 2023, renowned companies such as Dulux, Dunn-Edwards, Sherwin-Williams, and Pantone made their highly anticipated color of the year announcements. Aligning with the bold and vibrant theme observed in ceiling design, bold colors have emerged as the prevailing trend as we approach the summer season. This trend has particularly gained traction within the realm of interior design.

Our recent partnership with Material Bank echoes this overarching trend, as our standard solid color bar has ranked among the top choices in popularity. Notably, shades like Onyx Black and various tones of gray have been particularly trending in recent months.

This emphasis on bold colors injects a sense of energy and personality into interior spaces, creating visually captivating environments that make a statement. As companies and designers embrace this trend, we can expect to witness an array of striking color palettes and daring combinations in the months to come.

3. Mixed-use Developments

The trend of mixed-use developments is on the rise, driven by continued urbanization and the desire to create vibrant and livable communities. These developments combine residential, commercial, retail, and recreational components within a single structure, offering higher densities and diverse amenities. Investors are attracted to mixed-use properties for their steadier income streams, as different uses mitigate market fluctuations.

Tenants enjoy the convenience of having various services at their doorstep and businesses benefit from increased foot traffic and visibility.

The success of mixed-use projects relies on factors like sustainability, authenticity, convenience, and flexibility. Studies show that mixed-use development is increasingly prevalent and has proven to be a profitable investment. However, challenges exist, such as higher upfront investment, management complexities, and potential conflicts between different uses.

Mixed-use buildings that effectively address the challenges and still offer a profitable path (considering the current economic climate) will continue to attract investors.

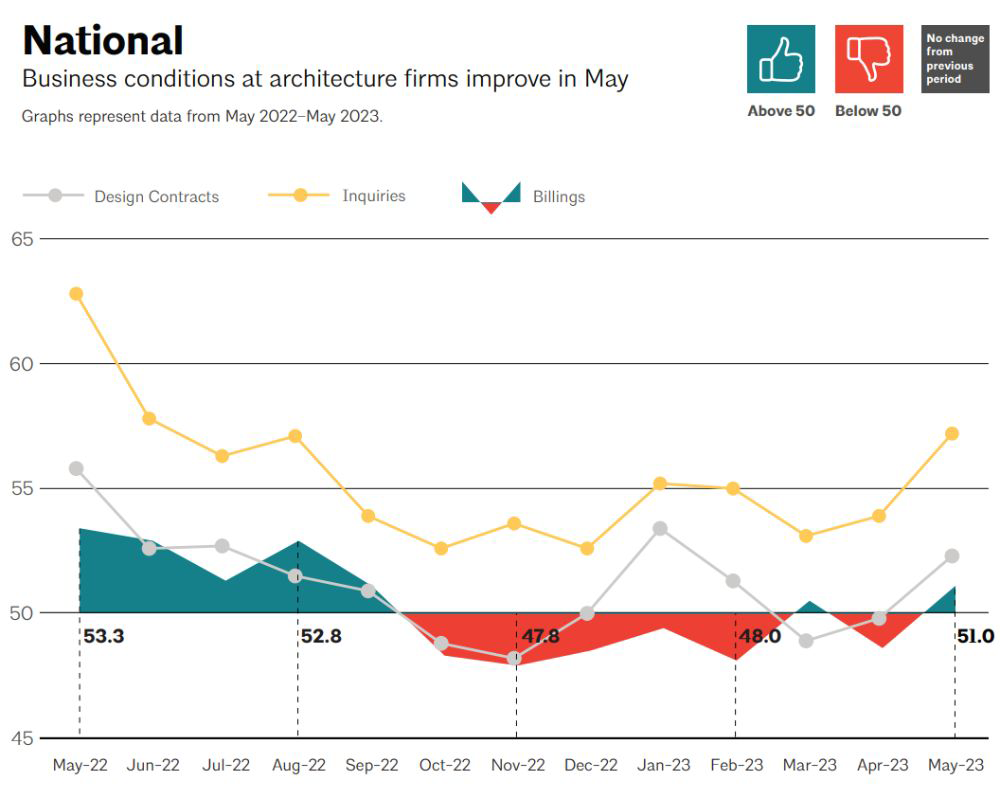

4. Architectural Billing Index

According to the ABI report, billings showed a slight increase for the month of May. Both design contracts and inquiries also experienced positive growth on a month-to-month basis.

Since August 2022, the Commercial/Industrial and Residential sectors have been facing a slowdown in billings. While the commercial and industrial sectors initially witnessed promising growth in the first three months of 2023, May witnessed a significant drop, with a score of 47.5 compared to April.

On the other hand, the institutional sector experienced a minor decline in late 2022 and early 2023 but has since shown consistent growth in billings year over year. This can be attributed to the healthy backlog of projects, which is likely driving the continued growth. It is expected that this sector will maintain steady billings throughout the remainder of the year.

Overall, architectural billings saw a slight increase in May, primarily driven by growth in the institutional sector. However, the commercial and residential sectors are expected to face challenges in 2023, including rising interest rates, inflation, and a volatile economic environment. Consequently, a slowdown is anticipated in these sectors.

Frequently Asked Questions

How are rising interest rates specifically impacting the affordability and availability of residential housing?

Rising interest rates affect residential housing affordability by increasing mortgage costs, which can deter homebuyers and slow down the housing market. This scenario can lead to a decrease in housing demand, impacting construction trends and investment in new housing projects.

What are the specific benefits and potential drawbacks of using low-carbon concrete in construction projects?

Low-carbon concrete offers environmental benefits by reducing carbon emissions associated with traditional concrete production.

However, it might present challenges such as availability, cost, and potential variations in performance compared to conventional concrete, which could affect its adoption in construction.

How do mixed-use developments contribute to community well-being and urban planning efficiency?

Mixed-use developments enhance community well-being by integrating residential, commercial, and recreational spaces, promoting walkability, reducing transportation needs, and fostering a sense of community. They contribute to urban planning by maximizing land use and facilitating diverse, sustainable urban environments.